Compared to the massive turmoil across all forms of media, the structure of live sports broadcasts looks relatively similar to the way it did 30 or even 40 years ago. National rights are bid on by the big networks, local broadcasts are owned by regional stations. The only major change is the emergence of the leagues themselves as media companies with the NFL, NBA and MLB all having their own dedicated linear cable channel. The checks have grown exponentially and the players at the local level have all consolidated. But for the most part the business of buying, producing and watching sports on TV is the same.

The next 5 years do not look to be nearly as peaceful. When Yahoo! announced it acquired rights to stream an NFL game this October, the blue print for the future started to be unveiled to the casual sports fan. Bob Iger pulled back the curtain more when he described an OTT service for ESPN as inevitable. Now traditional power CBS is streaming NFL games as well.

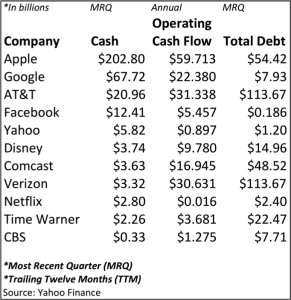

The cost to acquire these rights is a huge protective moat as are the length of the contracts. For traditional TV companies content rights is a regular operating expense. But for an outsider trying to enter the market a strong balance sheet could become a powerful weapon. Who has the dry powder to dramatically upend live sports broadcasts and with it all of the TV model? Here is a quick list of the companies that have both the means and a strategic connection to the content. Things could look very different when the next large contracts start to expire. Some of the largest checkbooks in the world are technology players that could acquire sports broadcast rights to bring eyeballs to their platforms.

Early candidates for displacement are the local rights holders outside the NFL/ NBA/ MLB triumvirate. Can a low cost technology player create a more compelling experience for watching the Columbus Blue Jackets or low level Division I Basketball? Clearly, yes. It’s easy to see a market for fans of Fordham Football or Siena College Basketball agreeing to a paid service that gives us just these games available (ok, maybe I’m the only one for those 2 teams but you get the point).

The best hope for traditional broadcasters may be the leagues themselves. Consumers cannot just up and switch their viewing habits like they moved from print newspapers. Leagues still get to determine to whom they sell rights. They may find they have a real need to maintain the status quo and give up revenue in order to hold on to governmental protections. Leagues enjoy great benefits such as tax exempt status, anti-trust exemption and low interest debt for new stadiums that could be plucked away if there is not enough consideration to local fans. But eventually even that may not be enough. The decline of the TV business model will thin out the margins of ESPN, Fox and CBS over time and watching Monday Night Football on YouTube and the World Series on Facebook will be the outcome.